WEEK OF OCTOBER 14, 2024

Welcome to the Traderverse Weekly Newsletter!

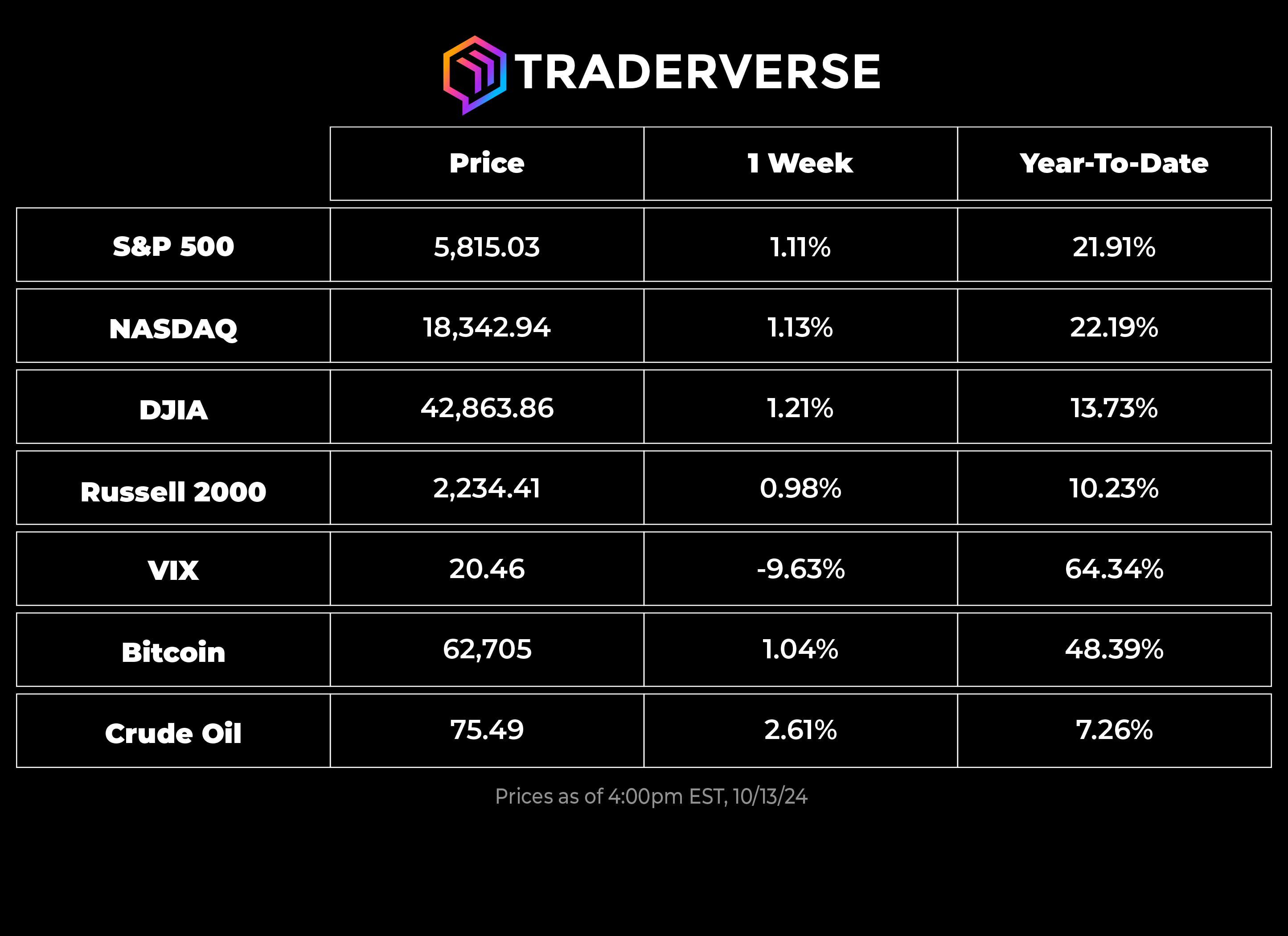

Important Prices

What’s Moving The Markets?

BlackRock (BLK) has surpassed $11.5 trillion in assets under management, driven by ETF inflows, crypto ventures, and major acquisitions like Global Infrastructure Partners and Preqin, positioning the firm for continued growth and dominance across traditional and emerging markets in 2024.

As the U.S. presidential race between Kamala Harris and Donald Trump tightens, investors are bracing for potential market volatility, with concerns that a disputed election result could lead to a sharp sell-off, as seen historically during politically uncertain periods.

Elon Musk unveiled Tesla’s ambitious plans for autonomous transportation, introducing a steering-wheel-free robotaxi and a 20-passenger robovan, both highlighting a shift towards robotic vehicles, with the robotaxi expected to be priced under $30,000 by 2026, though challenges in safety, regulation, and technology remain.

The September U.S. Consumer Price Index reveals a drop in inflation to 2.4%, marking the second consecutive decline and prompting the Federal Reserve’s first interest rate cut in four years, though inflation remains slightly above expectations, leading to market speculation about further rate reductions.

The U.S. DOJ is considering forcing Google to divest parts of its business, like Chrome and Android, to combat its alleged monopoly in online search, which could reshape internet usage, affect competition, and impact AI innovation, amid ongoing legal pressures from regulators.

In a recent interview, SEC Commissioner Mark Uyeda criticized the agency’s problematic approach to cryptocurrency regulation, labeling it a “disaster” due to a lack of clear guidelines and reliance on enforcement actions, which have contributed to industry confusion and legal turmoil.

S&P Outlook

Bear Case: Bears aim to establish bearish momentum by breaking and holding the price below 5724. If successful in achieving this initial step, the subsequent target becomes 5675, where they would need to break and sustain below to continue driving the market downward. These strategic moves are crucial for bears looking to dominate market trends.

Bull Case: Bulls continue to demonstrate strength by maintaining the price above the 5706 level and have now established a new potential demand zone starting at 5770. In the event of a price retracement, it is critical for bulls to keep the price above this new zone to enable the possibility of reaching new all-time highs. This level of support is key to sustaining bullish momentum and extending market gains.

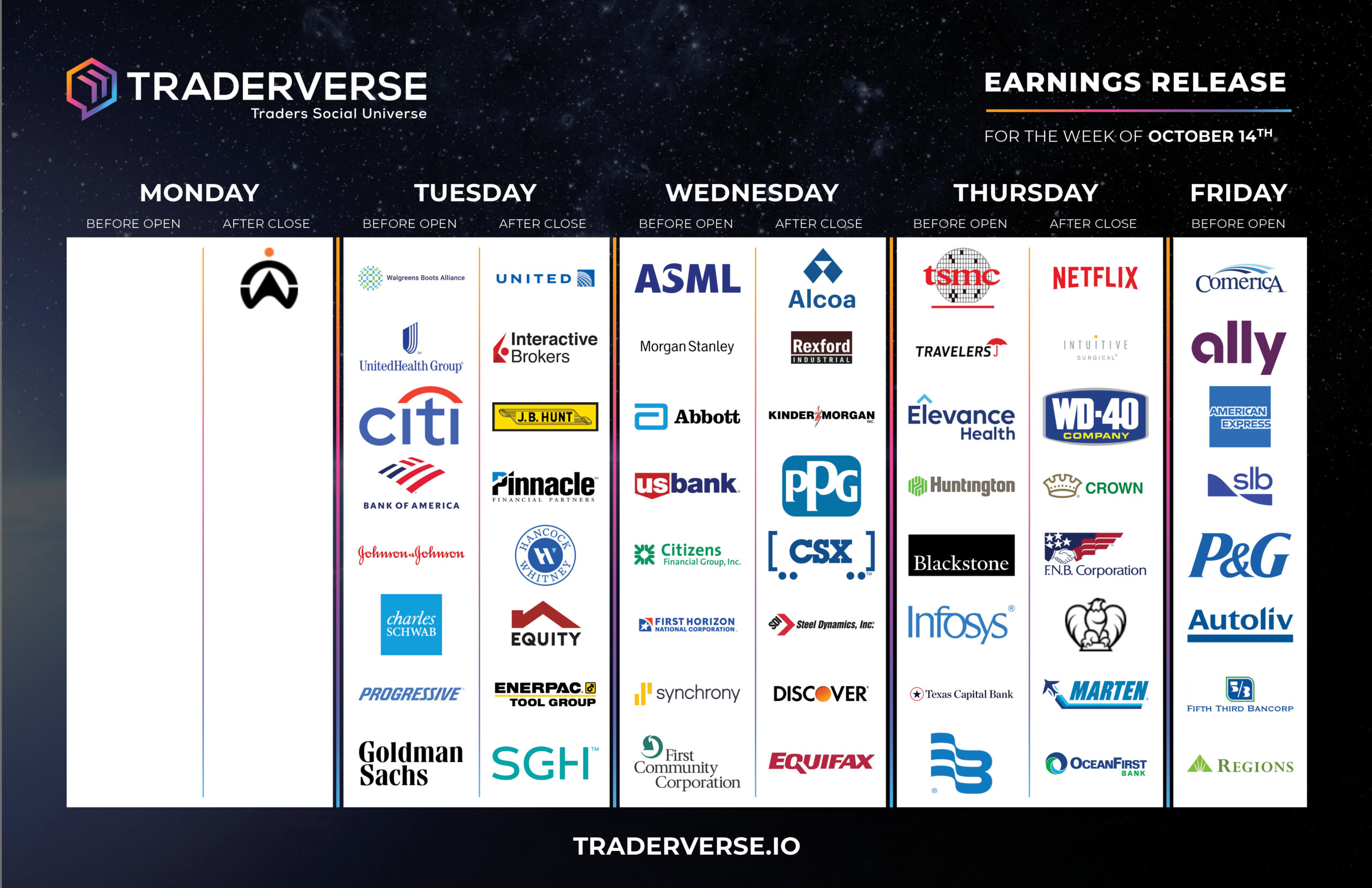

EARNINGS RELEASE CALENDAR

FOR WEEK OF OCTOBER 14tH

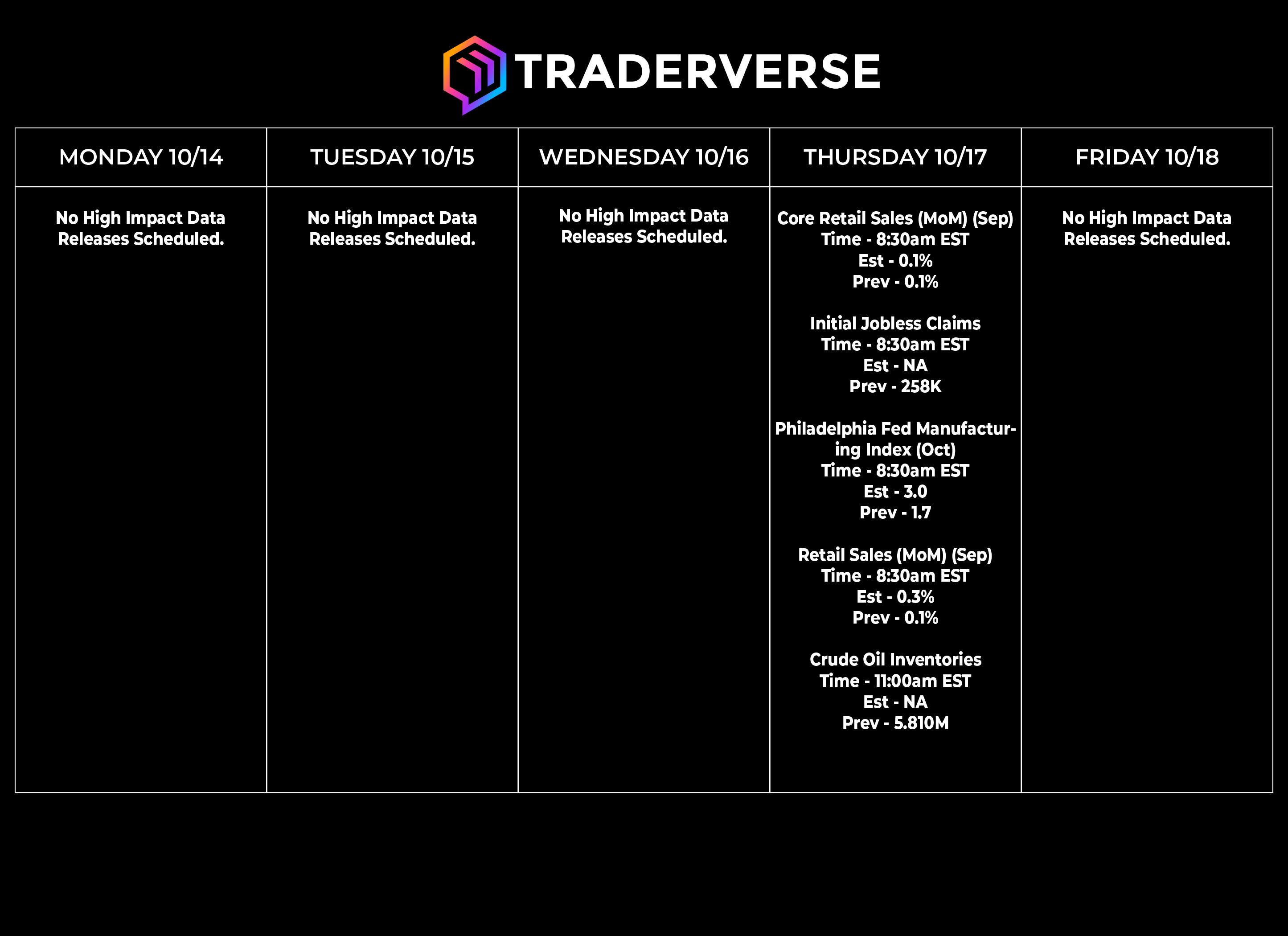

Economic Data Calendar