WEEK OF OCTOBER 28, 2024

Welcome to the Traderverse Weekly Newsletter!

We’re thrilled to announce that Traderverse will be attending DC Startup Week!

This exciting event brings together innovators, entrepreneurs, and investors, and we’re eager to showcase our vision for the future of social trading. We look forward to connecting with the vibrant startup community, sharing our journey, and exploring new opportunities for growth. If you’re attending, we’d love to meet you and discuss how Traderverse is transforming the trading experience.

See you in D.C.!

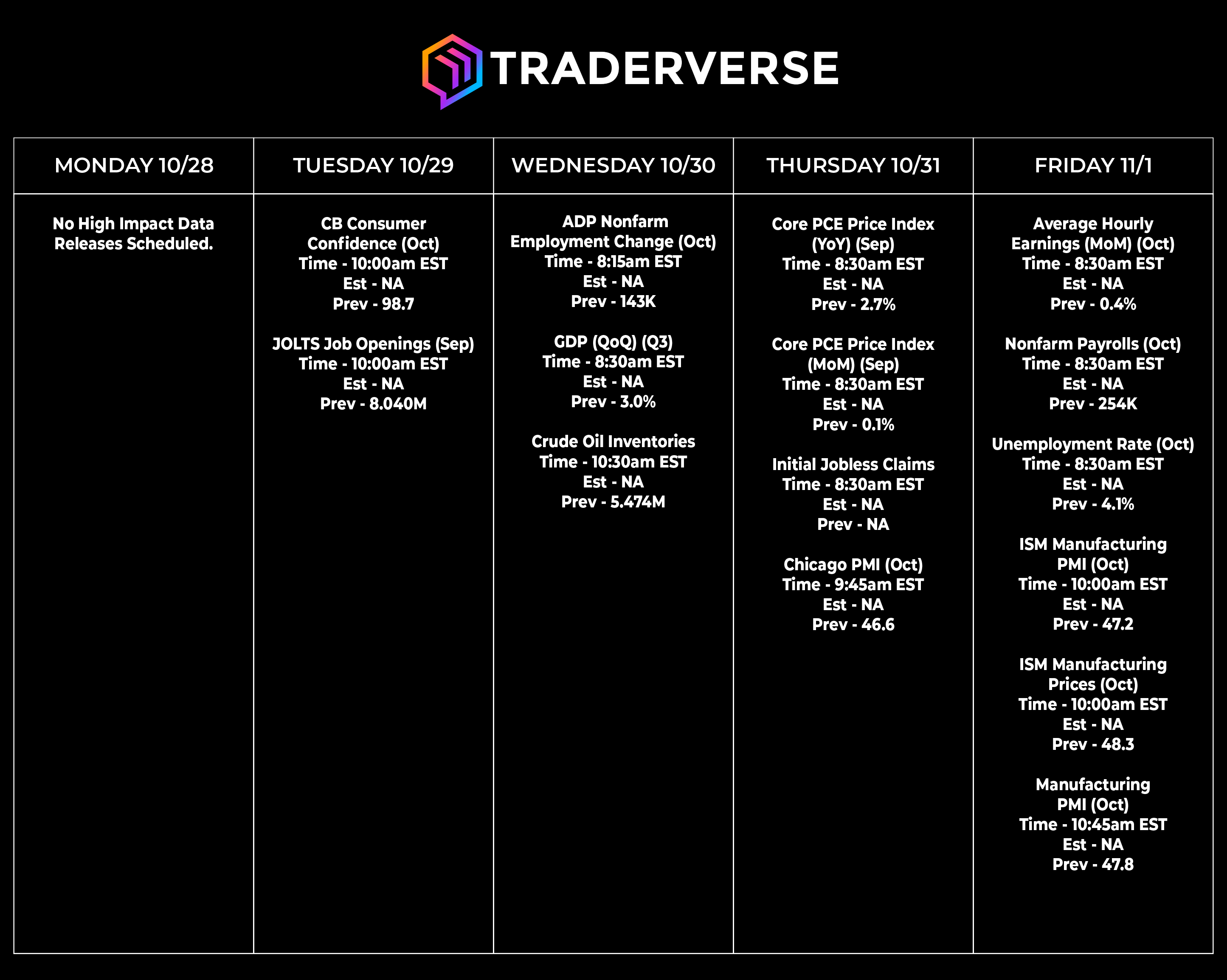

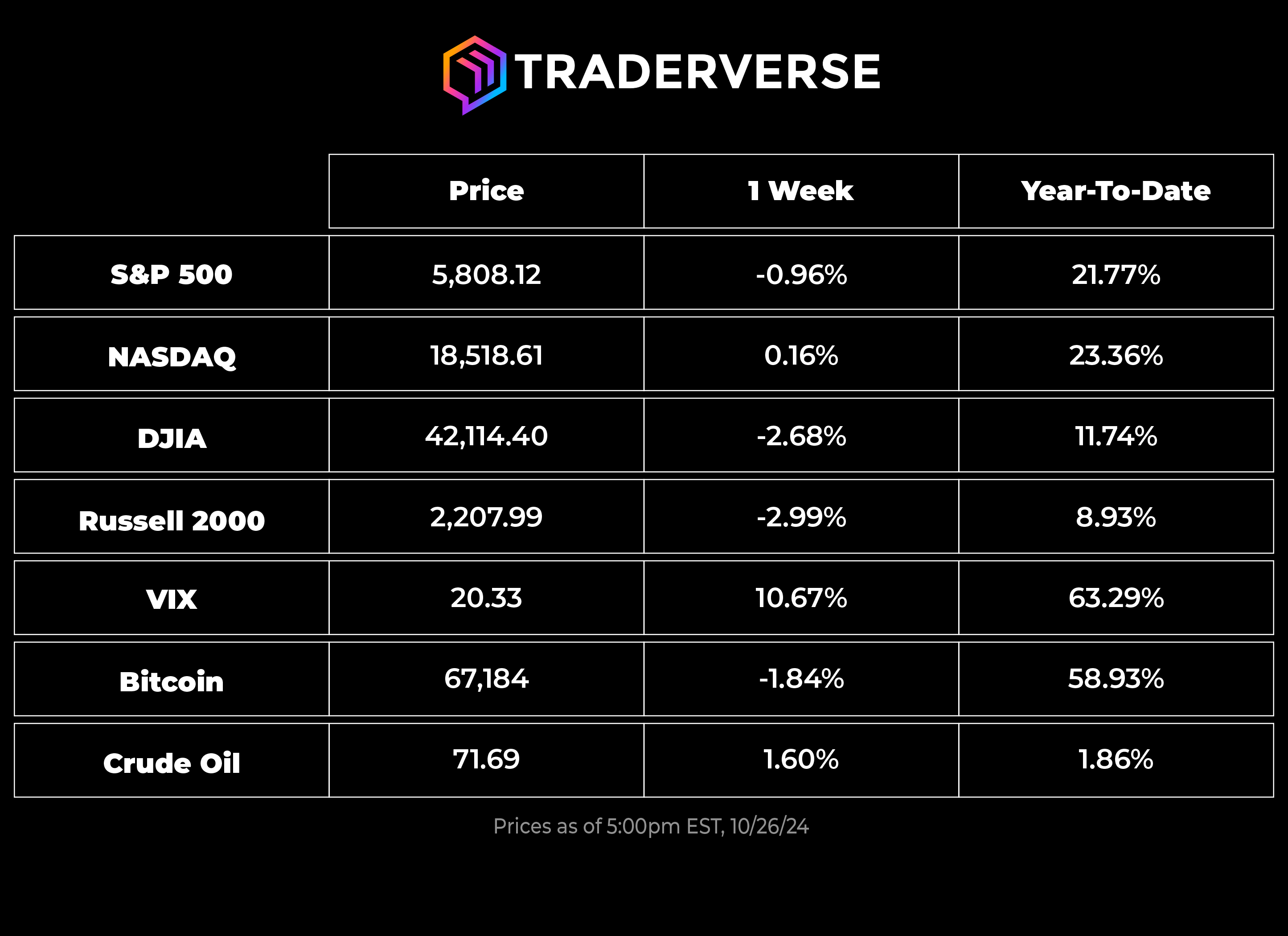

Important Prices

What’s Moving The Markets?

Donald Trump’s tax reform proposal aims to exempt approximately 93.2 million Americans from certain income taxes, eliminate taxes on tips and Social Security benefits, and generate revenue through a 20% universal tariff on imports.

The EU Court of Justice ruled in favor of Intel (INTC), concluding a nearly two-decade antitrust dispute with regulators over rebates to major manufacturers, upholding a prior judgment and reinforcing Intel’s competitive position in the semiconductor industry.

Taiwan Semiconductor Manufacturing Company (TSM) discovered one of its chips in Huawei’s Ascend 910B AI chip, prompting concerns of export violations, despite TSMC’s previous compliance since mid-September 2020, highlighting ongoing challenges in regulating tech exports to China.

UBS (UBS) is divesting its 50% stake in Swisscard to American Express (AXP), enabling full ownership transfer and cardholder transition to UBS’s platform, as part of its broader strategy to offload non-core assets following the Credit Suisse takeover.

Tesla (TSLA) shares soared nearly 22% after CEO Elon Musk projected a 20%-30% sales growth for the upcoming year and plans for a more affordable vehicle by 2025, boosting investor confidence amid ongoing concerns about the company’s focus on AI and robotics.

In 2024, the cryptocurrency sector has seen significant advancements, highlighted by Kraken’s upcoming Ink blockchain launch in 2025, aimed at enhancing decentralized finance activities and attracting both retail and institutional investors amid increased market interest and competition.

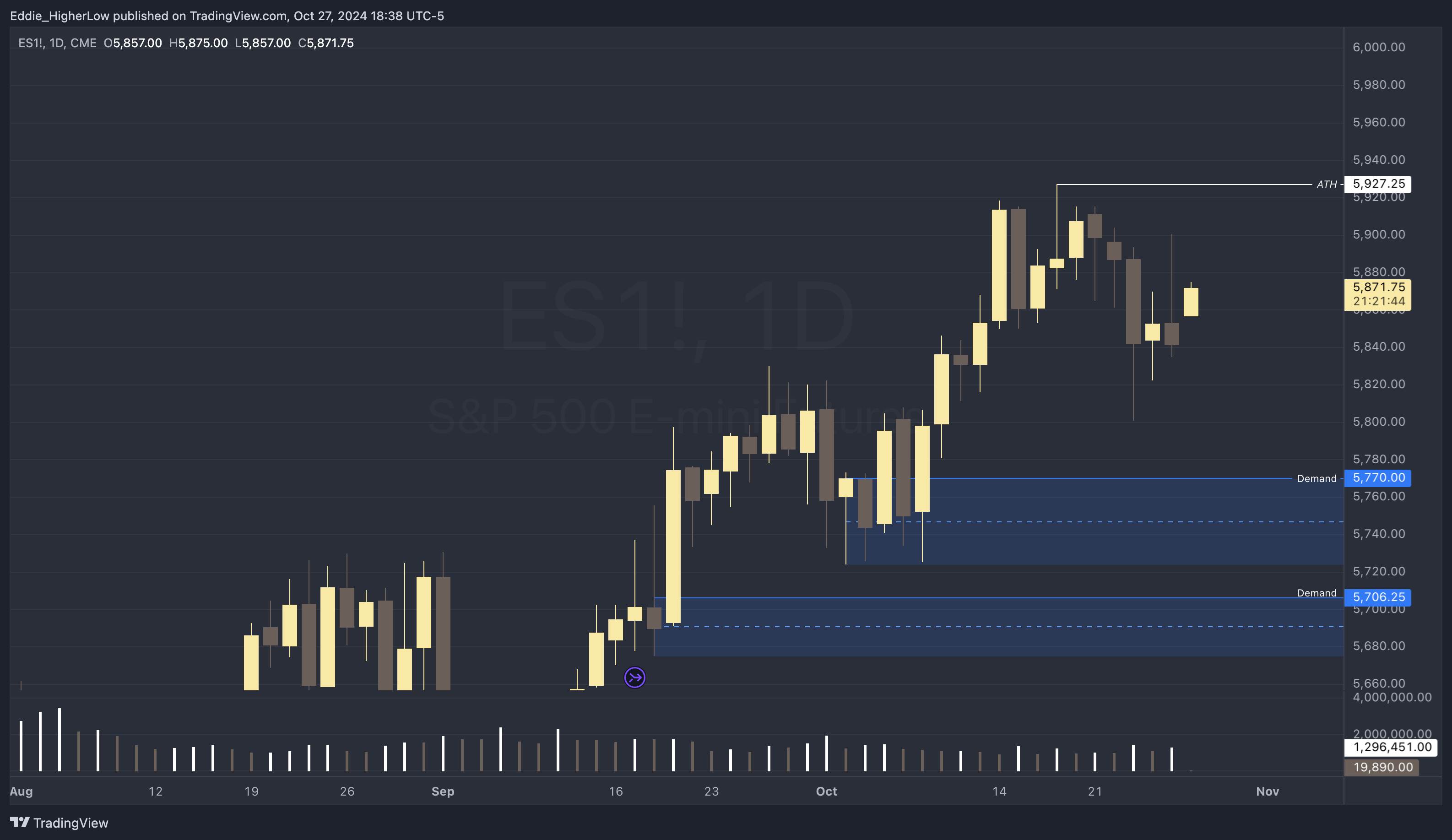

S&P Outlook

Bear Case: Bears have successfully dismantled the demand zone established last week, shifting their focus to further bearish objectives. The next critical step involves pushing the price below and sustaining it beneath 5723 to amplify their bearish momentum. This move is crucial for bears as they aim to deepen the market’s downward trajectory.

Bull Case: Bulls face the challenge of maintaining the price above 5770, a level where a significant demand zone has been recently formed. Successfully defending this level is vital for sustaining bullish control. If this support holds, bulls will aim to breach and secure positions above 5900 as a stepping stone towards achieving new all-time highs, continuing their upward market drive.

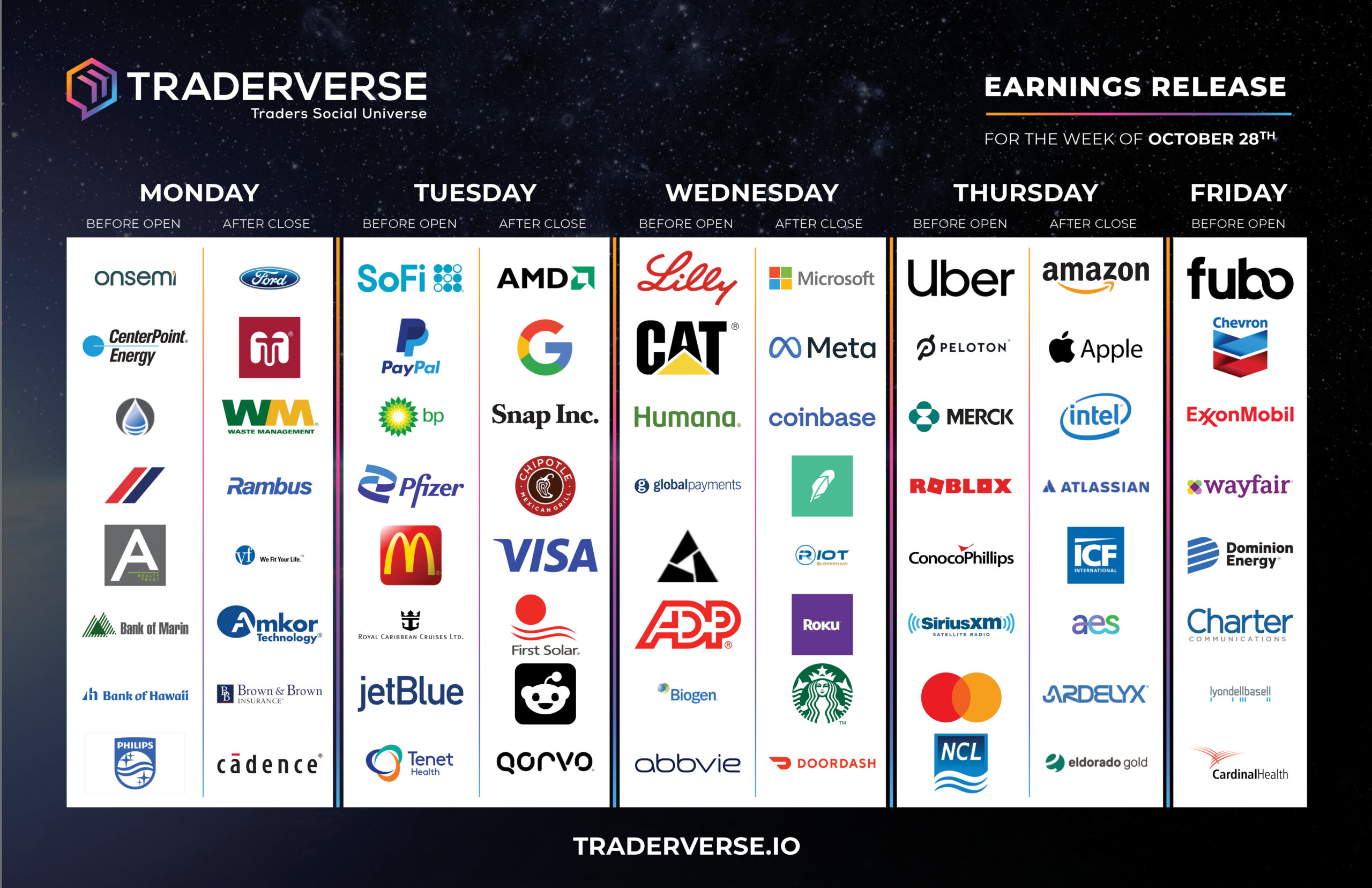

EARNINGS RELEASE CALENDAR

FOR WEEK OF OCTOBER 28TH

Economic Data Calendar