WEEK OF OCTOBER 7, 2024

Welcome to the Traderverse Weekly Newsletter!

Hey Traders,

Something big is coming this Wednesday, and we can’t wait to share it with you! Introducing Traderware Analytics, the game-changing tool that’s about to redefine how you trade. With advanced AI-driven insights once reserved for the pros, you’ll be equipped to make smarter, faster, and more informed decisions.

This is more than just another tool – it’s the foundation of Traderverse, and you’ll be among the first to experience it. Whether you’re a seasoned trader or just starting out, Traderware Analytics is designed to level the playing field and give you the edge you’ve been waiting for.

Curious? Stay tuned for Wednesday’s big reveal, where we’ll unveil exactly how Traderware Analytics will transform your trading strategy.

Get ready to trade like never before! Be sure to check your email Wednesday!

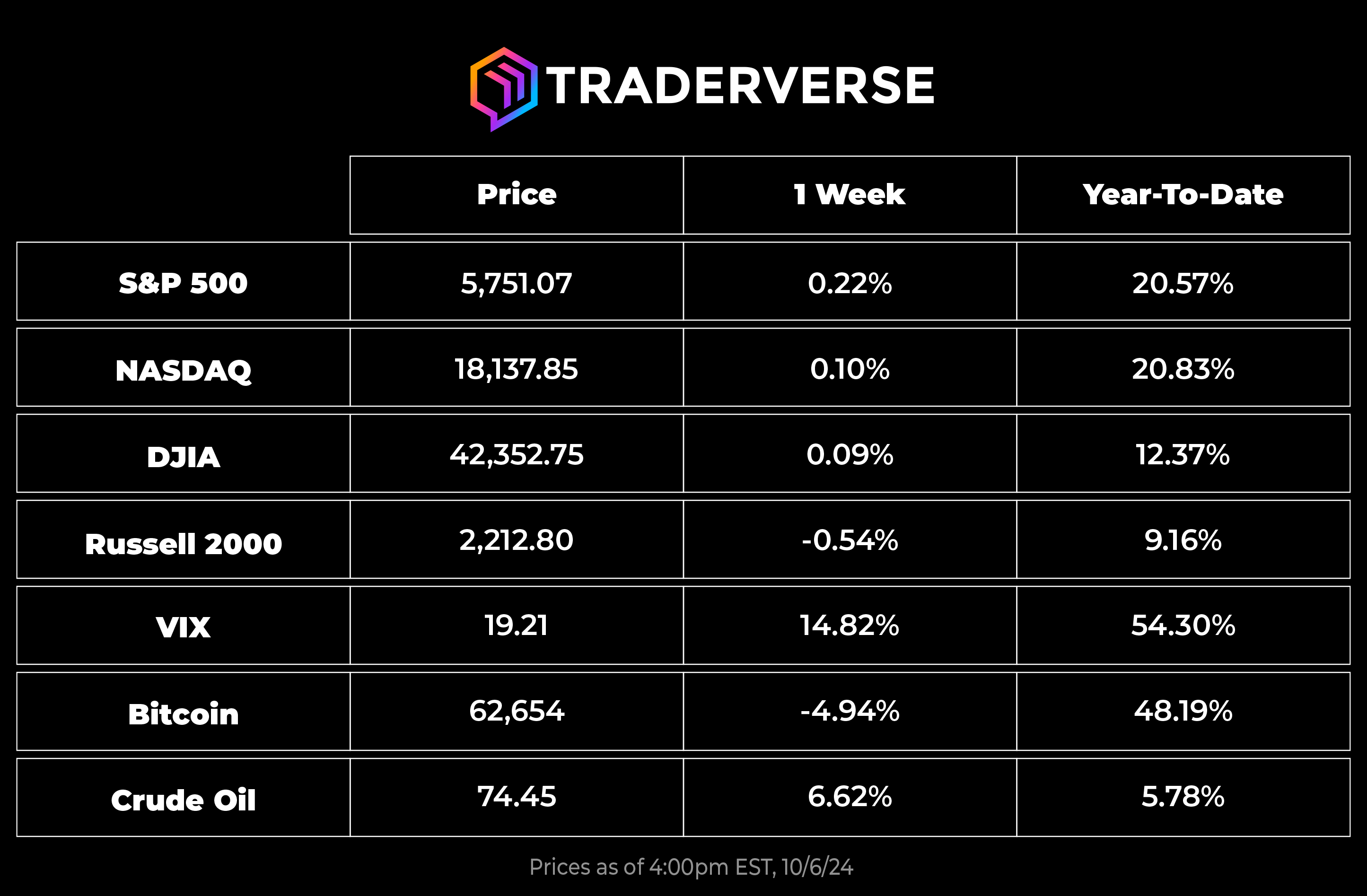

Important Prices

What’s Moving The Markets?

OpenAI has raised $6.6 billion in funding, elevating its valuation to $157 billion, attracting major investors like Microsoft (MSFT) and Nvidia (NVDA), amid corporate restructuring and leadership changes, while projecting significant revenue growth despite current losses, as it aims for artificial general intelligence.

The EU is set to impose substantial tariffs, potentially reaching 45%, on Chinese electric vehicle imports next month, sparking a major trade dispute amid internal divisions, particularly with opposition from Germany, while raising concerns about retaliatory measures from China and potential impacts on consumers and the automotive industry.

U.S. dock workers and port operators have tentatively agreed to a six-year contract, raising wages by 62%, halting a major strike that disrupted East and Gulf coast shipping operations; however, unresolved issues, including automation, raise concerns about the industry’s future and potential long-term economic impacts.

The European Union has intensified its scrutiny of social media algorithms, particularly focusing on YouTube, Snapchat, and TikTok, under the Digital Services Act, demanding detailed reports on content recommendation systems and their role in amplifying risks related to elections, mental health, and minors’ safety by November 15.

Berkshire Hathaway (BRKa), under Warren Buffett, has sold nearly $10 billion worth of Bank of America (BAC) shares since mid-July, reducing its stake by 23% in a strategic effort to simplify its portfolio, while still retaining a 10.2% share in the bank.

The UAE is exempting cryptocurrency transactions from VAT starting November 15, 2024, with retroactive application from January 1, 2018, simplifying VAT rules for virtual assets, exports, and financial services, reducing business costs and enhancing the nation’s appeal as a financial technology hub.

S&P Outlook

Bear Case: Bears are still focused on driving the price below the critical level of 5673 and maintaining it there to confirm their control. Successfully achieving this would enable them to target the next pivotal level at 5566. This strategic move is crucial for bears aiming to establish a stronger bearish momentum in the market.

Bull Case: Bulls are successfully sustaining the price above the crucial demand zone at 5706. This persistent support highlights the ongoing bullish control in the market. Maintaining this level is key for bulls to continue their upward trajectory and further solidify their market dominance.

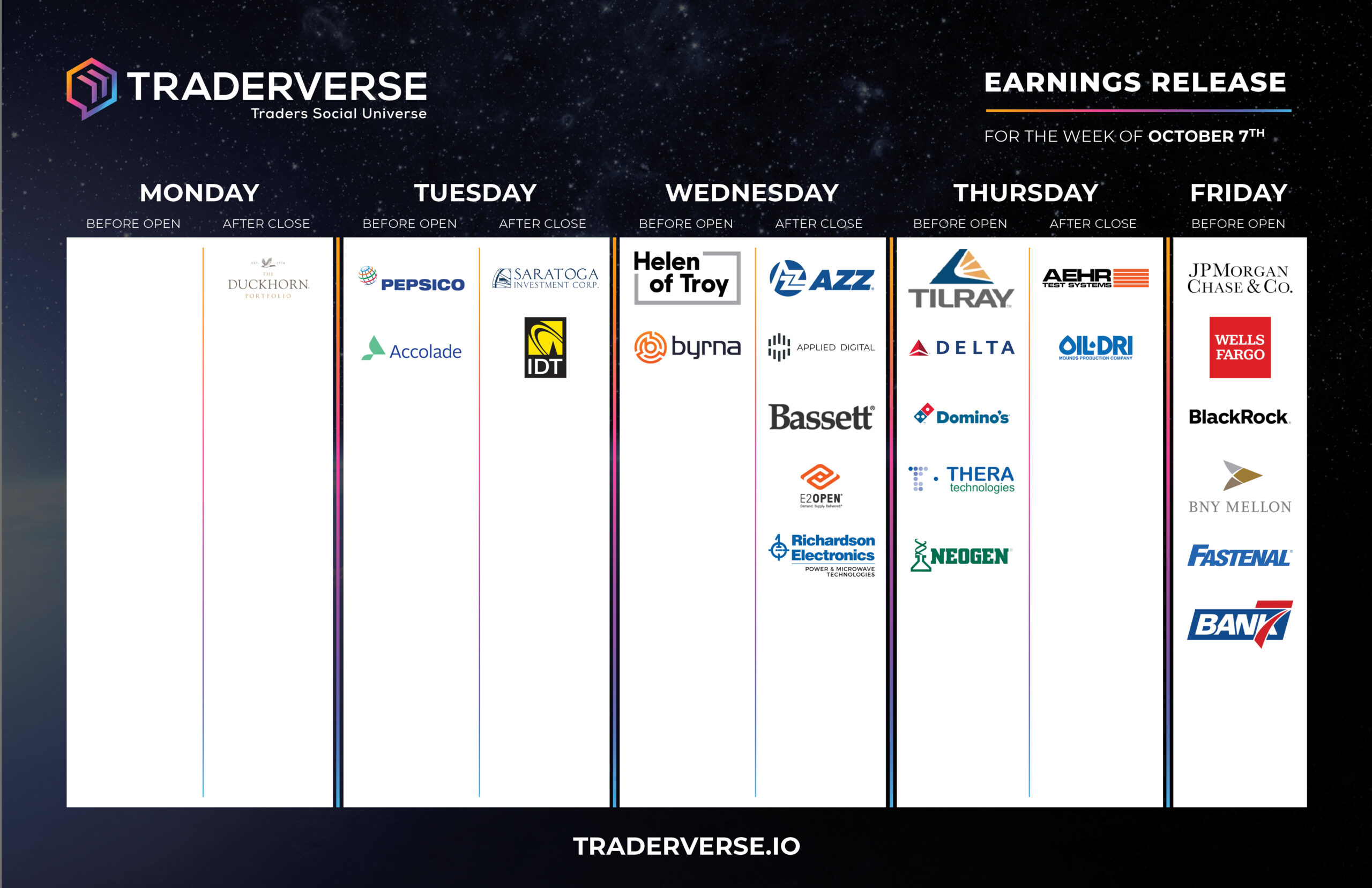

EARNINGS RELEASE CALENDAR

FOR WEEK OF OCTOBER 7tH

Economic Data Calendar