WEEK OF DECEMBER 2, 2024

Welcome to the Traderverse Weekly Newsletter!

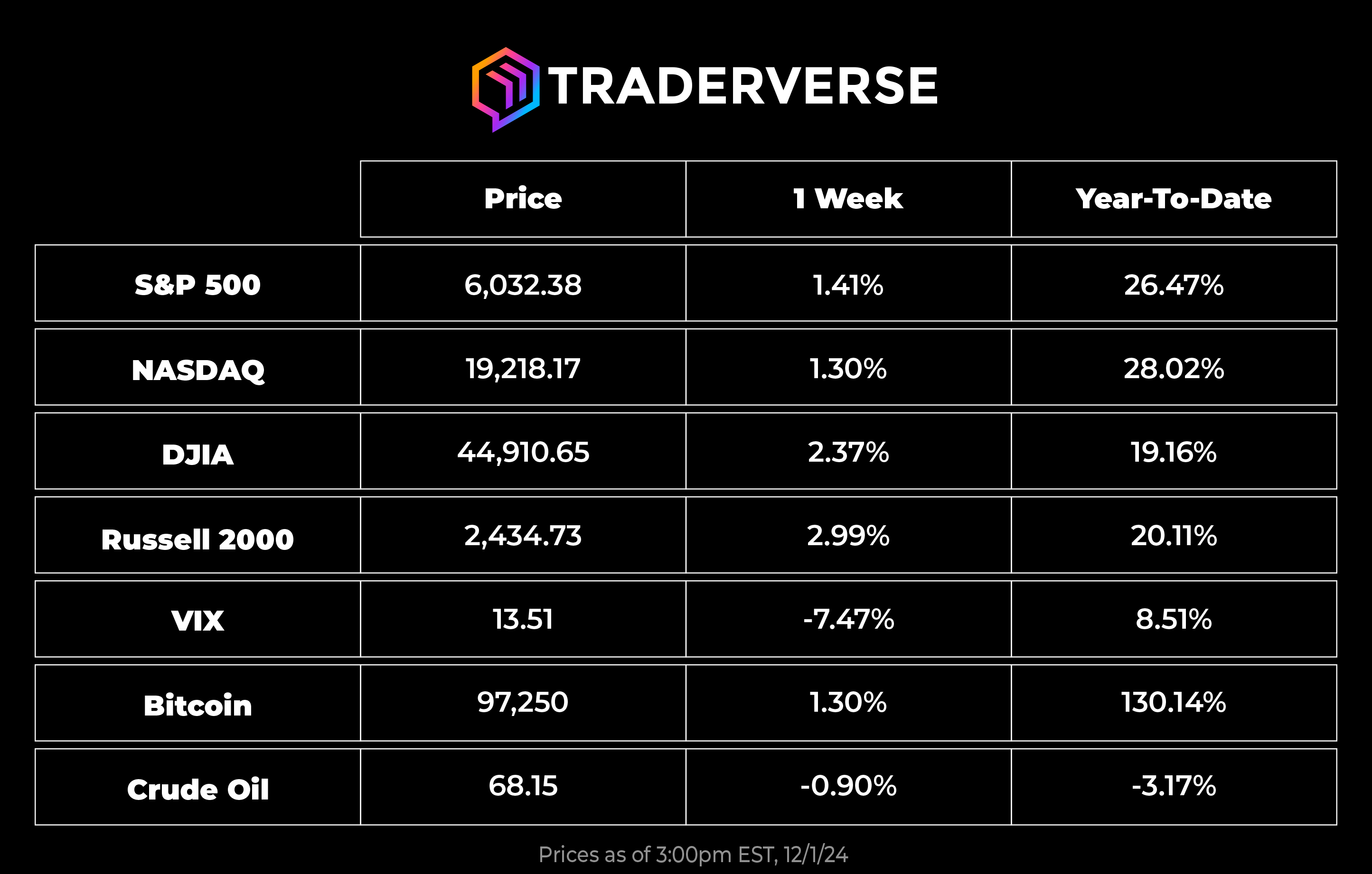

Important Prices

What’s Moving The Markets?

The FTC has launched an antitrust investigation into Microsoft (MSFT), targeting cloud and licensing practices amid allegations of anti-competitive behavior, with potential political shifts under Trump’s presidency likely influencing its outcome and broader Big Tech scrutiny.

The U.S. Commerce Department has awarded Intel (INTC) a record $7.86 billion CHIPS Act subsidy to boost domestic semiconductor manufacturing, reflecting a historic investment in reshoring critical production, and reducing foreign reliance.

President Biden’s proposal to expand Medicare and Medicaid coverage for costly anti-obesity drugs like Novo Nordisk’s (NOVO) Wegovy and Eli Lilly’s (LLY) Mounjaro aims to improve accessibility and reduce patient expenses, sparking political debate.

Rivian Automotive has received conditional approval for a $6.6 billion loan from the U.S. Department of Energy to support its Georgia EV plant, aiming to scale production of affordable electric vehicles and compete with major industry players.

India is revising its electric vehicle policy to attract foreign automakers like Toyota, Hyundai, and Volkswagen by broadening incentives for production at existing plants, with finalized guidelines expected by March to boost local EV manufacturing.

The UK’s Financial Conduct Authority (FCA) plans to regulate cryptocurrency by 2026, outlining a comprehensive approach to address market abuse, disclosures, and ecosystem research, positioning the UK as the first EU country to regulate crypto markets.

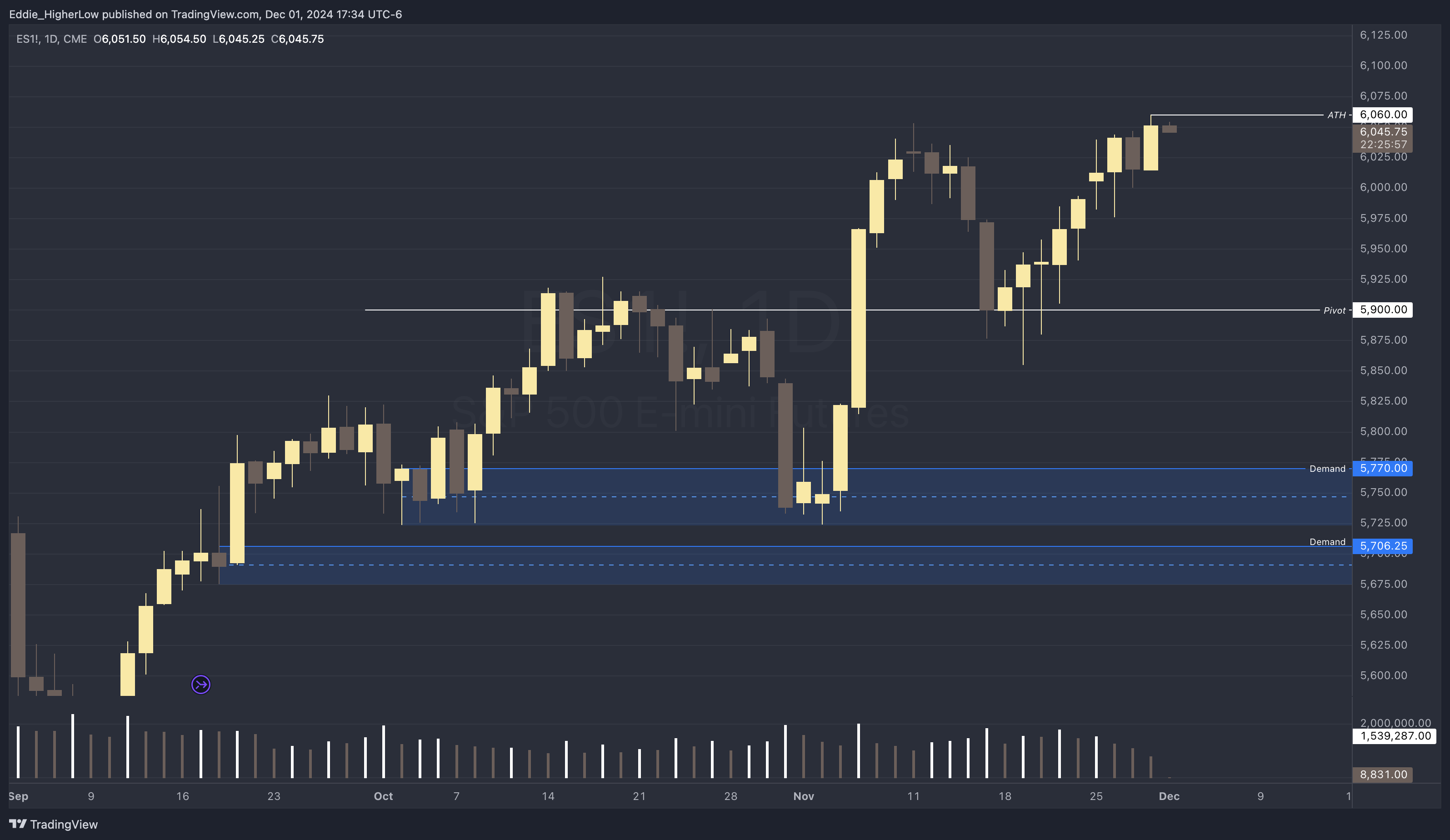

S&P Outlook

Bear Case: Bears next goal is to push the price below the crucial 5900 level and sustain it there to secure bearish momentum. Successfully breaking and holding below 5900 would set the stage for targeting the next significant level at 5770, which is essential for continuing the bearish drive and gaining further market control.

Bull Case: Bulls have successfully maintained the price above the psychologically significant 5900 level. If price encounters resistance and fails to advance, it remains critical for bulls to hold above 5900 to position themselves for potential new all-time highs.

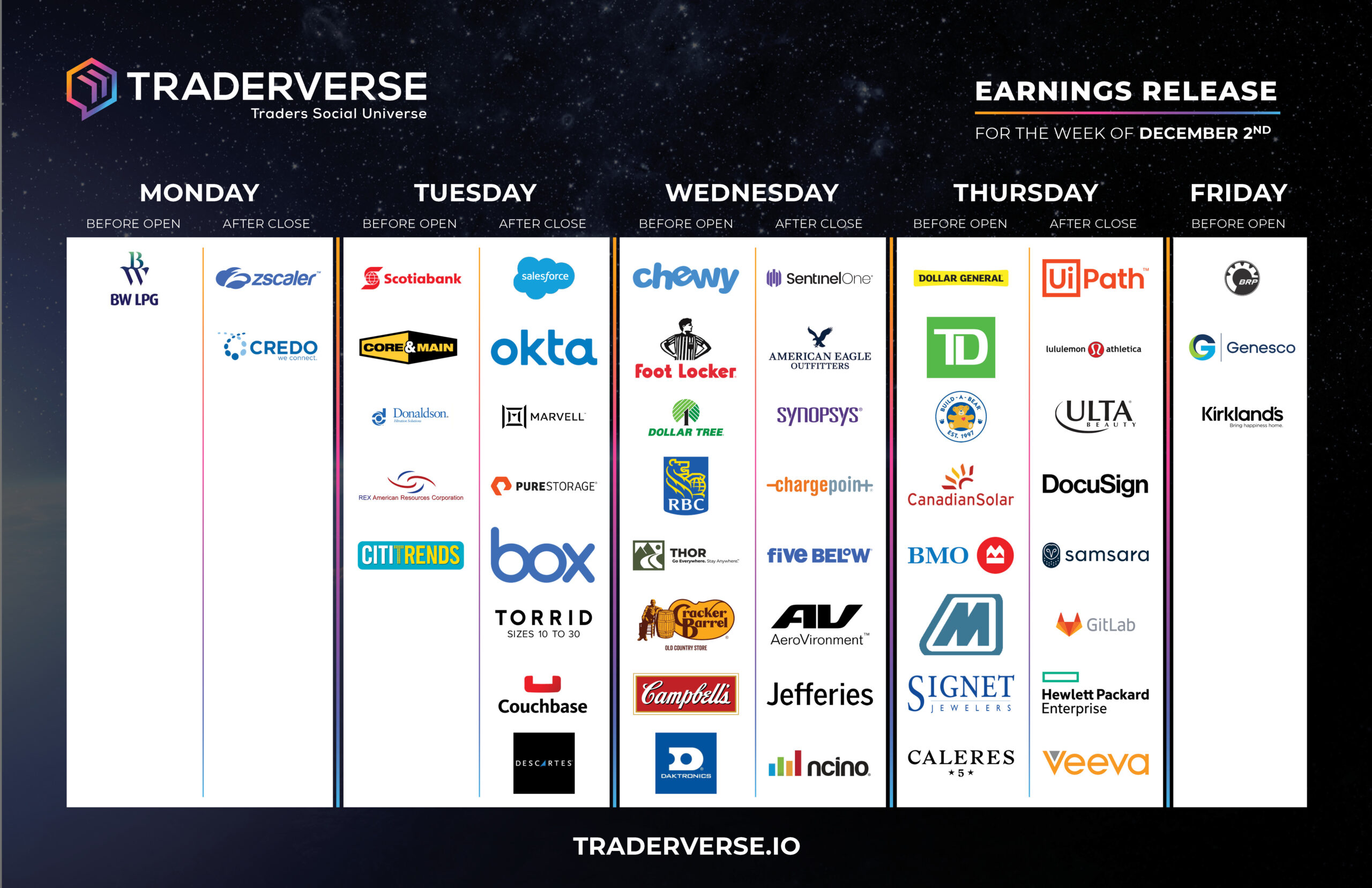

EARNINGS RELEASE CALENDAR

FOR WEEK OF DECEMBER 2nd

Economic Data Calendar