WEEKLY MARKET OUTLOOK

FOR THE WEEK OF JUNE 12, 2023

Welcome to the Traderverse Weekly Newsletter! We are thrilled to welcome you to our trading community!

Each week, we provide you with the most up-to-date stock, crypto, & real estate information and charts, so you can stay informed and optimize your trading decisions. Thank you for joining us!

Happy trading!

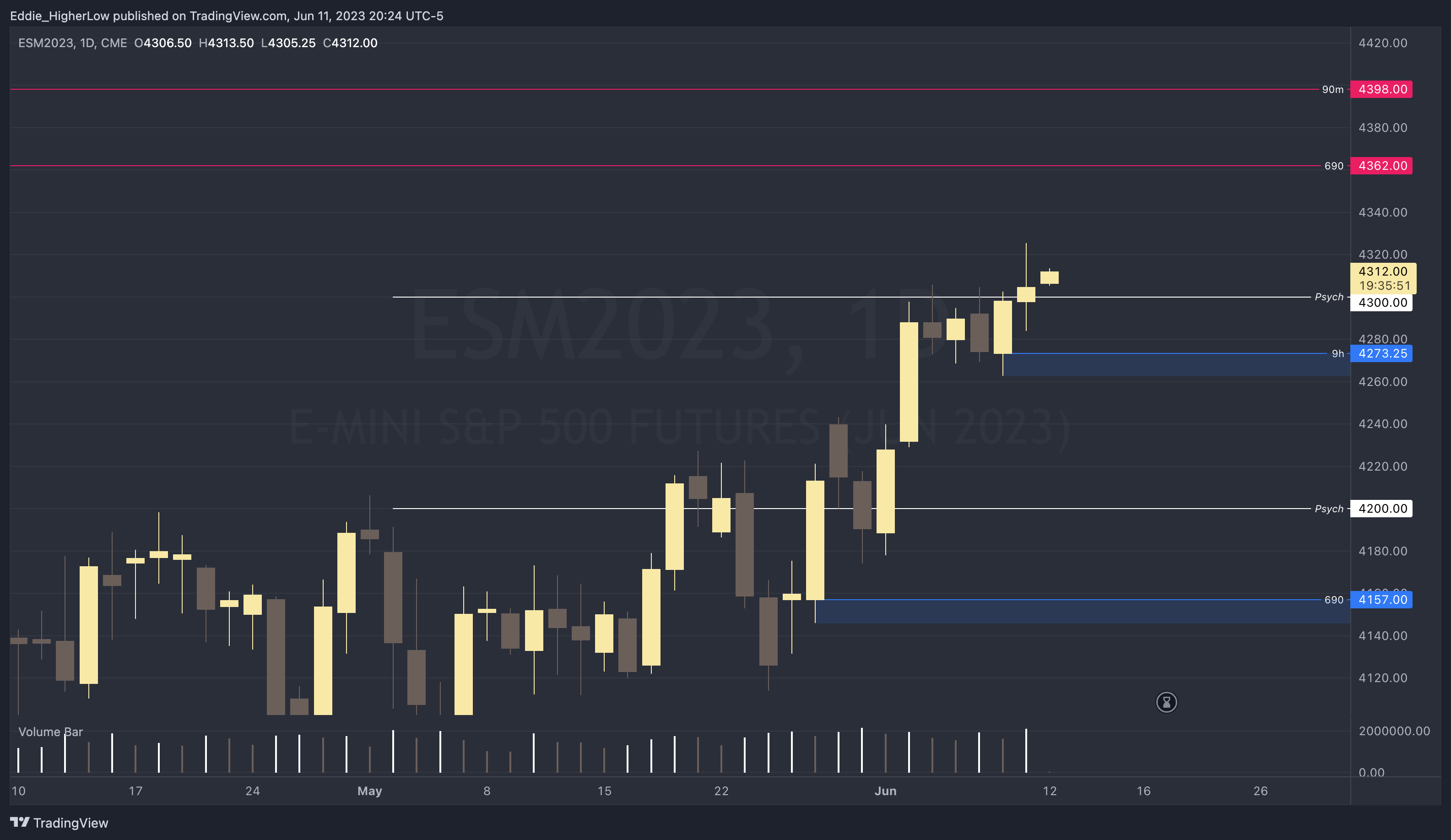

Important Prices

S&P Outlook

Bull Case: Price currently trading above 4300 where bulls will like to hold but if price breaks below, possible 9 hour demane sits at 4273.25. If price continues to hold above 4300, no strong supply until 4362 and 4398.

Bear Case: Bears will need to break below 4300 then 4262.75 to begin setting lower highs but if price continues trading above 4300, there is an untested supply zone at 4362 and 4398 which could act as possible resistance.

What’s Moving The Markets?

This Week’s Fed Meeting

The Federal Reserve’s next rate decision is drawing near and, as such, speculation of its direction is rampant. Markets largely believe that the Fed will opt to hold rate hikes come next week and are focusing heavily on economic data in the days ahead. Currently, data shows that the probability of the Fed holding rates at the June 13-14 meeting is now at 82% from 36% just a week earlier. This figure is expected to continue rising in the days ahead as the market looks for any indication of the Fed’s chosen course of action heading into this week’s meeting. If the Fed decides to hold rates, the markets will likely see a slight bump.

Big Tech Possibly Facing Regulatory Action

Meta Platforms’ Instagram, Alphabet’s YouTube, TikTok and Twitter could face regulatory action after European consumer group BEUC complained to the European Commission and consumer authorities that the online platforms allegedly facilitate the misleading promotion of crypto assets. Recent turmoil in the cryptocurrency markets have sparked concerns over consumer protection related to crypto assets such as bitcoin and ether. The complaint filed against these tech giants said the proliferation of misleading advertisements of crypto assets on the social media platforms is an unfair commercial practice as it exposes consumers to serious harm such as the loss of significant amounts of money.

SEC vs Binance

The SEC has filed a lawsuit against both Binance and CEO Changpeng Zhao (CZ) for alleged violations of securities laws following additional recent regulatory measures taken against the company by the CFTC. Binance also stated that it is disheartened by the decision of the commission to move forward with the lawsuit, calling the matter “unilateral”, with CEO CZ stating that they are ready to defend themselves vigorously. In light of the ongoing lawsuit, Binance US, has made this decision to suspend USD deposits starting June 13, 2023.

SEC vs Coinbase

The SEC has sued crypto exchange Coinbase claiming that the exchange allowed traders and investors to buy, sell, and trade crypto asset securities, but they have never registered with the SEC as a broker, national securities exchange, or clearing agency. This claim accuses the exchange of evading the disclosure regime that Congress has established for the securities markets. The agency also contended that Coinbase “never registered” its staking-as-a-service program as required by the securities laws. This lawsuit comes on the heels of the lawsuit against Binance that the SEC filed just one day before.

Russia's Largest Bank Offering Crypto Trading

The largest bank in Russia, Sberbank, is set to offer crypto trading services to its customers , allowing them to buy and sell cryptocurrencies, starting in June. The bank’s chairman of the board assured that customers will be able to buy and sell what the bank calls CFAs, which are backed by a hybrid of assets and securities. With this new development, investors and traders with an interest in the world of digital assets could bring more liquidity to the bank. While the United States has continued its crackdown on the digital asset industry, the world is continuing to move forward.

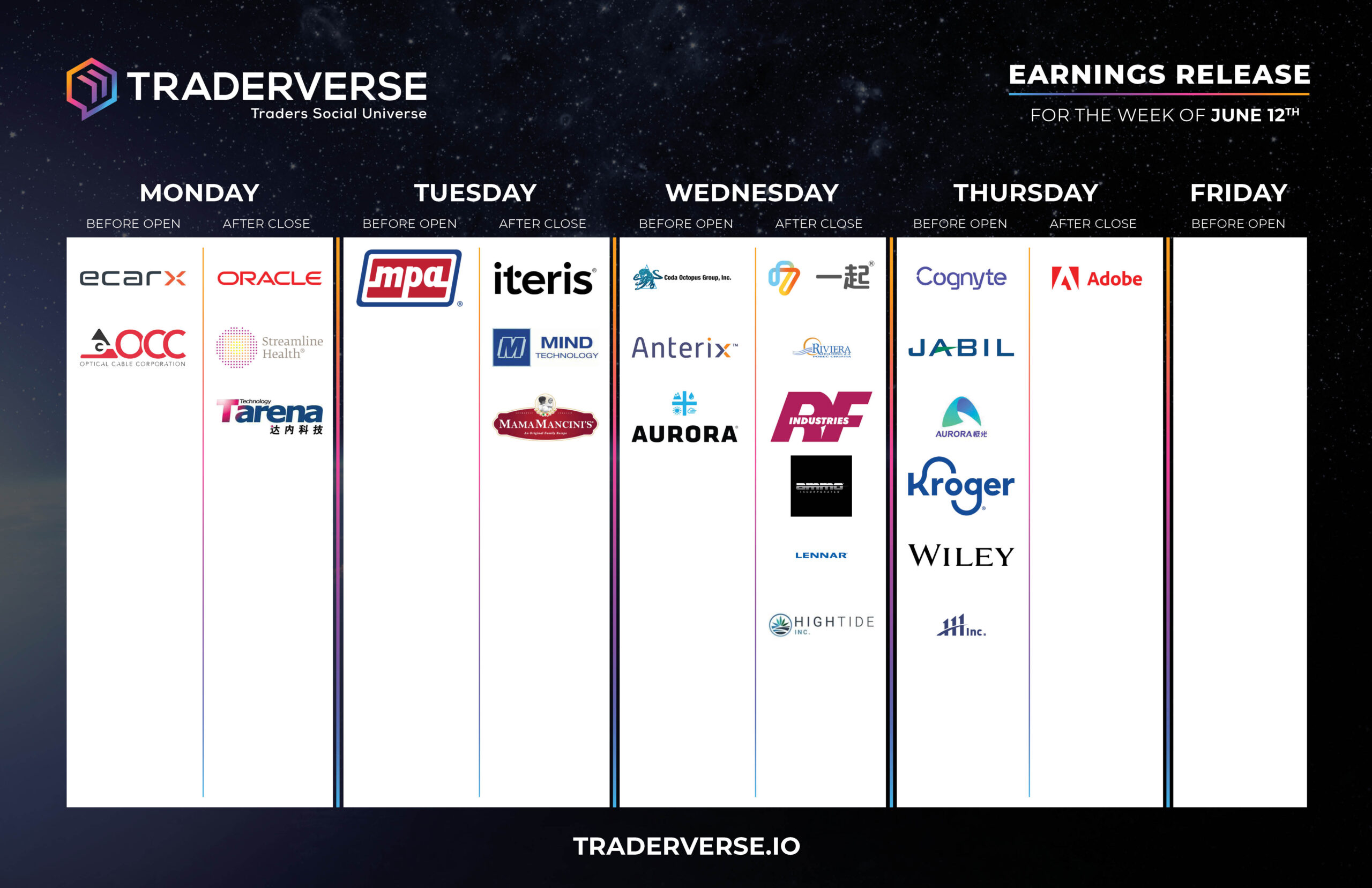

EARNINGS RELEASE CALENDAR

FOR WEEK OF JUNE 12th

Expert Insights & Predictions

Our research got us into Nvidia at the end of Dec 2022. We called out their explosive move back in February of this year before the massive artificial intelligence run. Yes, we were in Nvidia before most of the general public and continue to hold a sizable long position with options expiring 2025.

We believe Upstart can also make a similar run in the next 3-6 months here. On a technical basis, the sentiment of this chart has clearly shifted from bearish to bullish. A powerful and healthy demand zone is being formed as of late. You can confirm from the increasing volume on the weekly timeframe.

Our first target is $42+ then $55+ but overall, we are extremely bullish on this chart and won’t be surprised if it goes north of $80+ early 2024. Here’s why we like Upstart on a fundamental analysis perspective:

- They recently secured an additional $2-billion dollars worth of funding from their investors.

- Massive short squeeze potential if they deliver in the 2H 2023.

- They recently invested more money in building out their proprietary AI-lending platform which provides consumer loans using non-traditional variables such as education and employment to predict creditworthiness.

- The FEDS are likely to ease off interest rates by year end. This will be one of the biggest economic catalysts boosting Upstarts top line revenue and bottom-line income.

- We believe their current losses will narrow in the next coming quarters working their way towards being cash flow positive in 2024.

Despite the economy slowing down, a severe recession has been avoided. The S&P 500 is trading 20% off the October 2022 lows. We think it’s still early to get into Upstart especially with long-dated options expiring in 2025 with a strike price of $30 and $40. This is not financial advice by any means. Always manage your risk and understand nothing is guaranteed in the stock market.

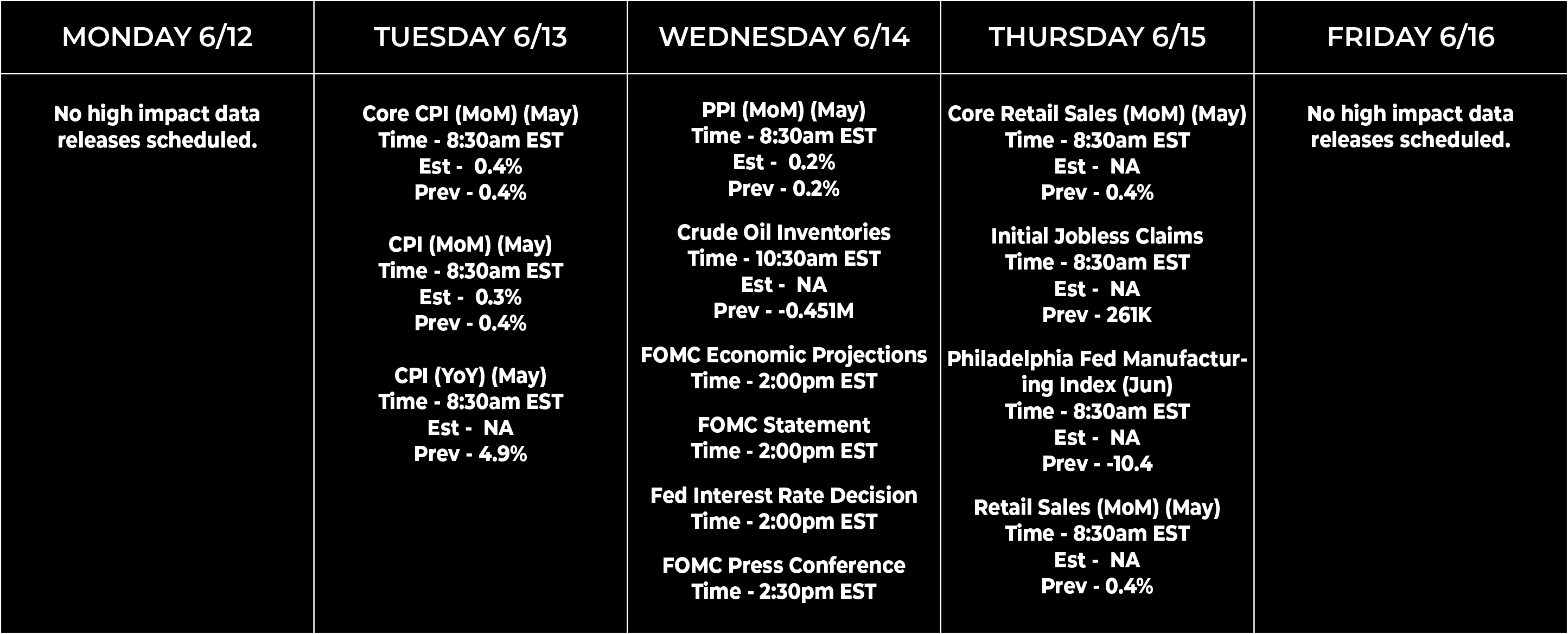

Economic Data Calendar