WEEK OF AUGUST 5, 2024

Welcome to the Traderverse Weekly Newsletter!

Traderverse Updates

Welcome to another edition of the Traderverse newsletter! In these turbulent times, we want to remind our community of the importance of maintaining a broad perspective, especially during a down market.

Navigating the Current Down Market:

Market downturns can be challenging and often lead to a sense of uncertainty. However, it’s crucial to remember that market fluctuations are a natural part of the financial landscape. As traders and investors, our goal is to not only weather these storms but to use them as opportunities for growth and learning.

Zoom Out on Your Perspective:

When faced with a declining market, it’s easy to get caught up in the daily volatility and short-term losses. We encourage you to zoom out and consider the long-term trends and potential of your investments. Historically, markets have demonstrated resilience and the ability to recover and grow over time. By focusing on the bigger picture, you can make more informed decisions that align with your long-term financial goals.

Stay Informed and Strategic:

In these moments, staying informed and strategic is key. Use the tools and resources available on Traderverse to analyze market conditions, review your investment strategies, and adjust your portfolios as necessary. Remember, every market cycle brings new opportunities for those who remain vigilant and patient.

Thank you for your continued support and enthusiasm. Together, we're revolutionizing the way traders connect, discover and grow.

Important Prices

What’s Moving The Markets?

Federal Reserve Chair Jerome Powell indicated that the Fed might cut interest rates in September if economic conditions remain stable, continuing to pursue a balanced approach toward inflation and employment, with markets responding positively to the news.

Microsoft’s increased AI spending amid slower Azure cloud growth led to a drop in share price, though Azure growth is expected to accelerate in late fiscal 2025; AI services notably boosted revenue, with total revenue rising 15% to $64.7 billion in Q4.

Apple has opted for Google’s tensor processing units (TPUs) over Nvidia’s GPUs for its AI software infrastructure, marking a strategic shift highlighted in a recent research paper and potentially challenging Nvidia’s dominance in the AI hardware market.

Tesla is recalling 1.85 million vehicles in the U.S. due to a software failure that may not detect an unlatched hood, risking obstruction of the driver’s view and potential crashes, with the recall affecting several models from 2020-2024.

Intel is cutting its workforce by over 15% and suspending dividends in order to address financial struggles and refocus on AI chips, resulting in the company’s largest drop in share price ever amidst increased competition, weak revenue forecasts, and substantial cost-cutting measures.

In H1 2024, Tether achieved record profits of $5.2 billion, driven by a $1.3 billion net operating profit in Q2, and set a new milestone with $97.6 billion in U.S. Treasuries, reflecting strategic asset allocation and financial stability.

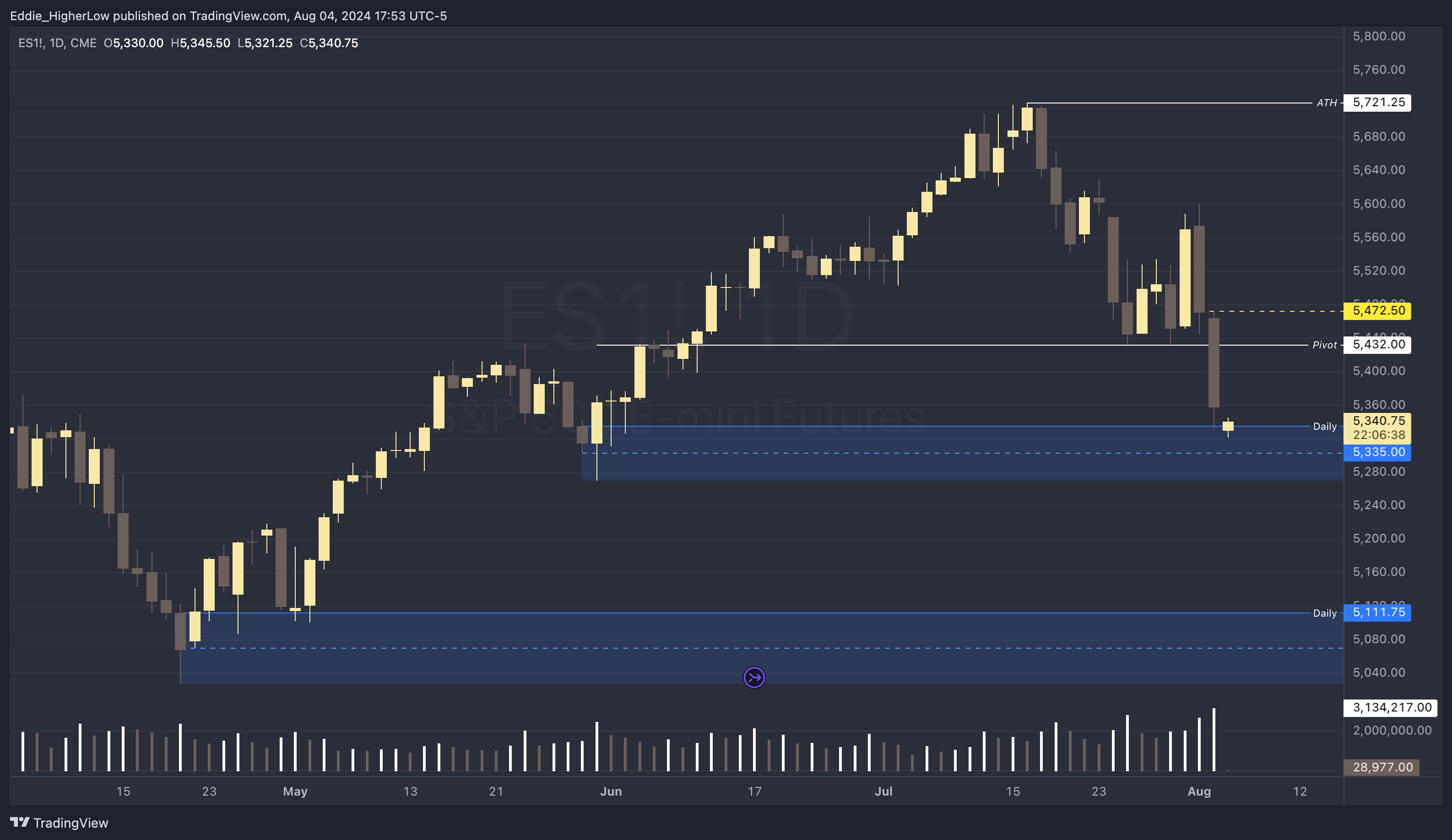

S&P Outlook

Bear Case: Bears have successfully exerted control and are now focusing on maintaining the price below the 5432 pivot level. This strategic position is crucial for bears to continue driving the market downward, reinforcing their dominance and enhancing bearish momentum.

Bull Case: Bulls are currently positioned within a potential daily demand zone that has proven significant in past tests. To shift the market dynamics, bulls need to break and sustain above the 5432 pivot. Achieving this is essential for initiating upward movements. Should the price break above, the next key level to watch is 5472.50, which may be filled with trapped longs and where bears are likely to mount a strong defense.

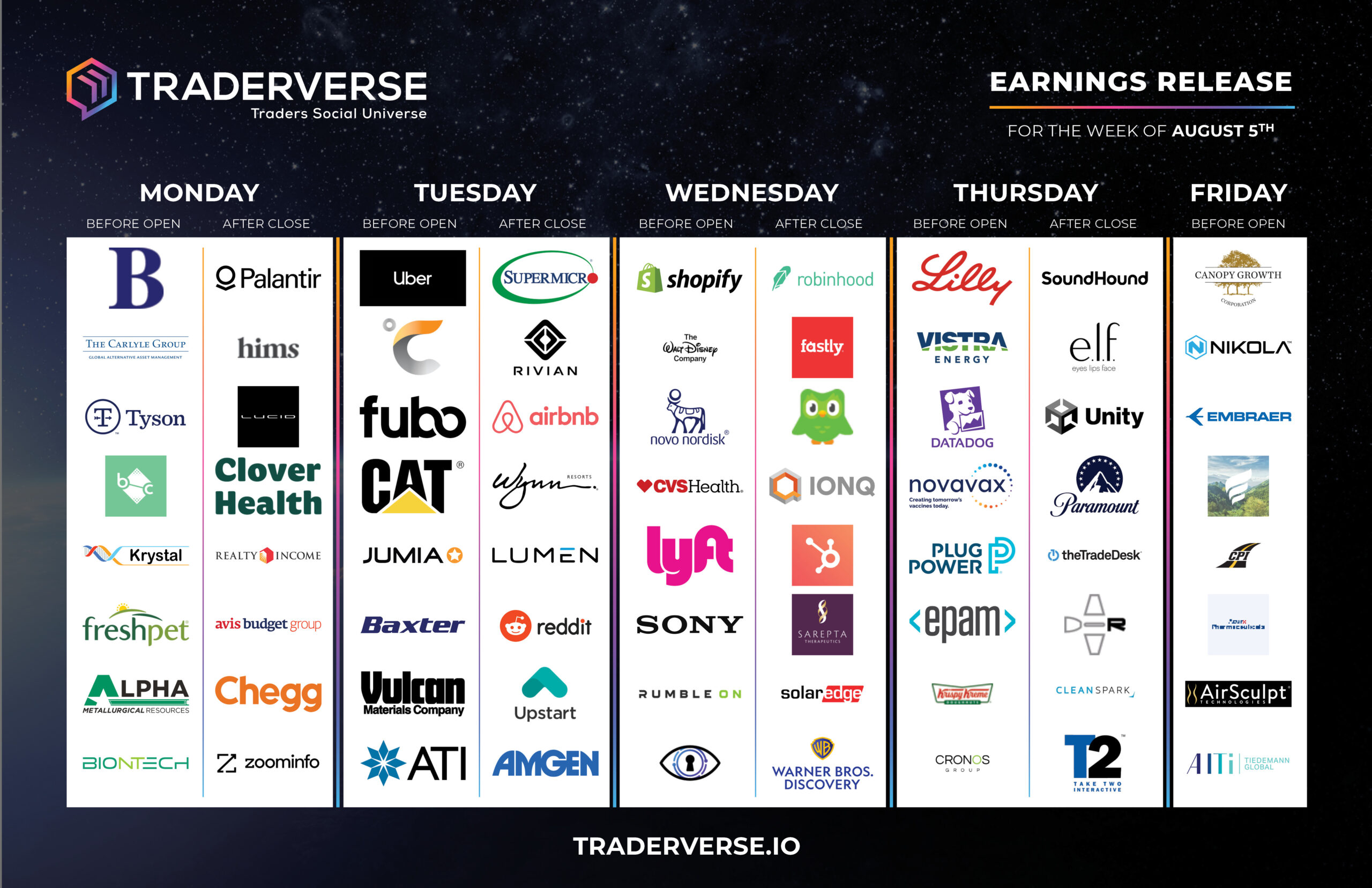

EARNINGS RELEASE CALENDAR

FOR WEEK OF AUGUST 5TH

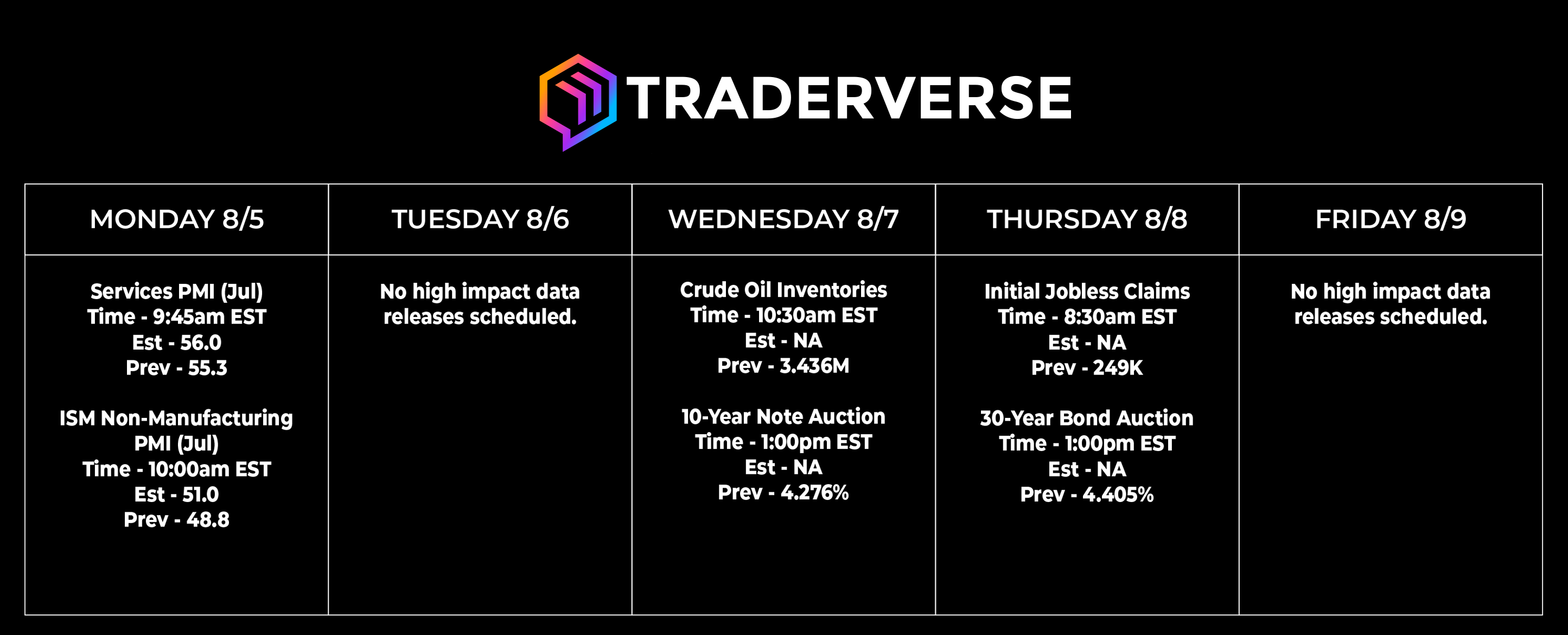

Economic Data Calendar