WEEK OF A SEPTEMBER 11, 2023

Welcome to the Traderverse Weekly Newsletter!

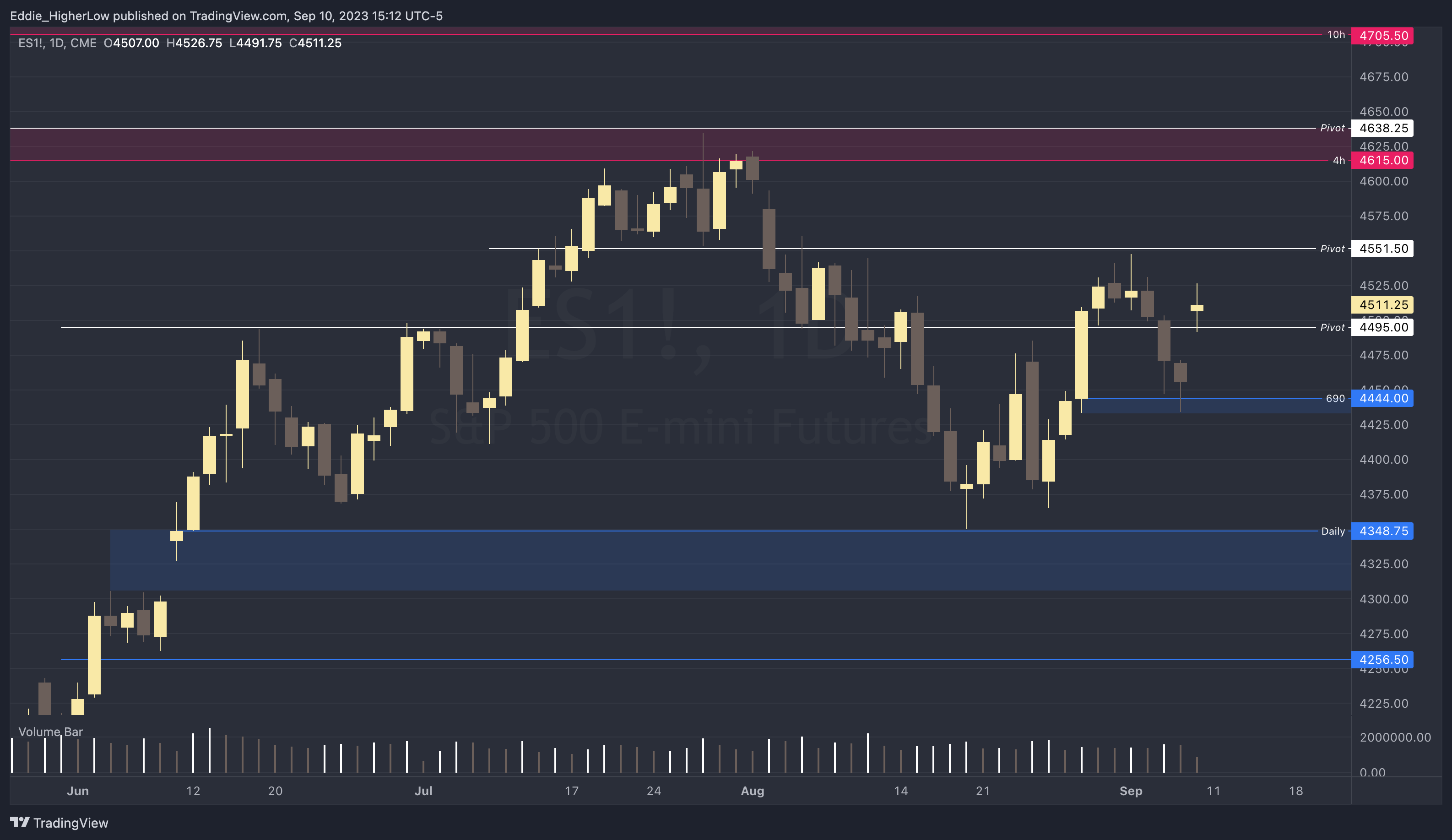

Important Prices

What’s Moving The Markets?

Apple’s Chip Deal

Apple has entered a long-term chip technology agreement with Arm, extending beyond 2040, as revealed in Arm’s IPO documents; simultaneously, Arm has announced its plans for a $52 billion initial public offering, the largest in the US for the year.

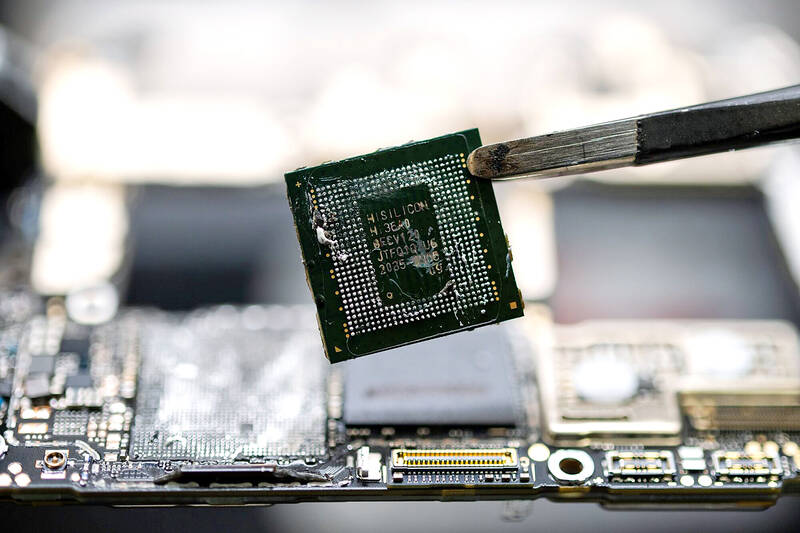

China’s Chip Breakthrough

Huawei has employed an advanced 7-nanometer processor, the Kirin 9000s, manufactured by China’s leading chipmaker SMIC, to drive its Mate 60 Pro smartphone, as confirmed by a teardown analysis by TechInsights.

IPhone Banned In China

Tech giant Apple has lost $200 billion in market value last week, in part due to China banning its federal government, expanding to local governments and state-owned entities, from using iPhones.

JPMorgan’s Blockchain-Powered Token

JPMorgan Chase is in the process of creating a blockchain-powered digital deposit token aimed at expediting cross-border payments, with the majority of the necessary infrastructure already developed, pending approval from U.S. regulators.

Spot Ethereum ETF

Ark Invest and 21Shares have filed for approval to launch the first-ever US ETF that directly invests in Ether, the second-largest cryptocurrency, setting a historic precedent in the cryptocurrency investment arena and differentiating their ETF from others by holding actual Ether, not Ether futures.

Visa Expands To Solana

Visa is broadening its stablecoin settlement options by partnering with Solana (SOL) and merchant acquirers Worldpay and Nuvei, allowing it to send USDC from its treasury to these firms for facilitating merchant payments; Visa’s preference for Solana over Ethereum is attributed to Solana’s faster transaction speeds and lower fees.

S&P Outlook

Bull Case:Bulls will want to hold price above 4495 if it retraces. If price does break below, possible demand at 4444 but since it has been tested once already, do not expect it to be as strong. If price is able to break and hold above 4551.50, not much supply until 4615.

Bear Case: Bears will need to continue to hold price below 4551.50 pivot. If bears are able to break below 4490, next target would be 4444 then ultimately testing low at 4348.75.

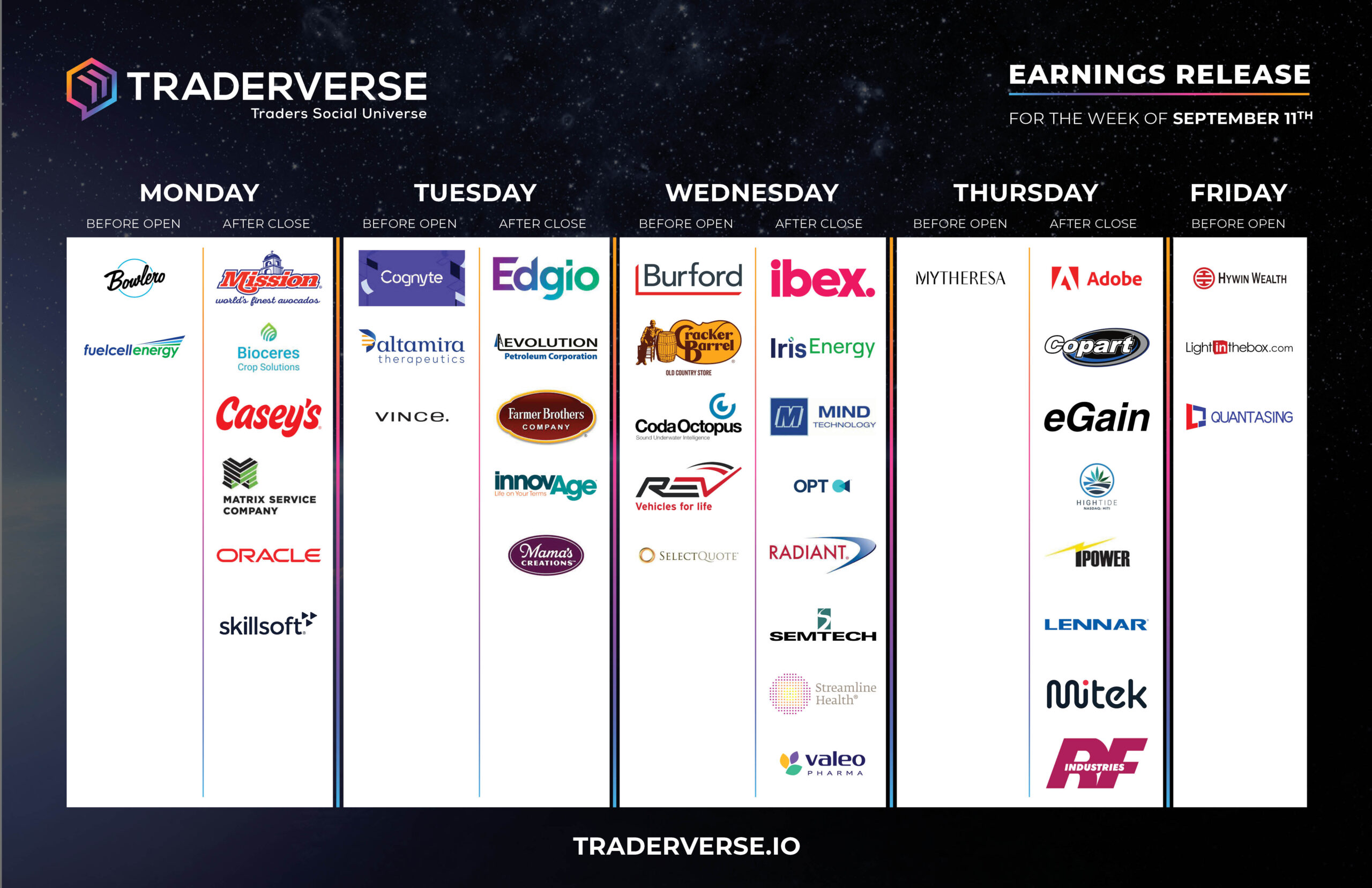

EARNINGS RELEASE CALENDAR

FOR WEEK OF SEPTEMBER 11th

Expert Insights & Predictions

SPY 30-minute and daily analysis

SPY 30-minute consolidating in a bear flag and looks like an incomplete bear count. Expecting new lows into 30 min demand around 441 for wave 5 as long as the price stays below 448. Daily sell-in pops are still in play, imo, and expecting the price to break the 18 Aug lows post-Opex. Currently working on Wave 1 of Wave C and the bigger sell-off can come after wave 2 is done. — @BullsCorner

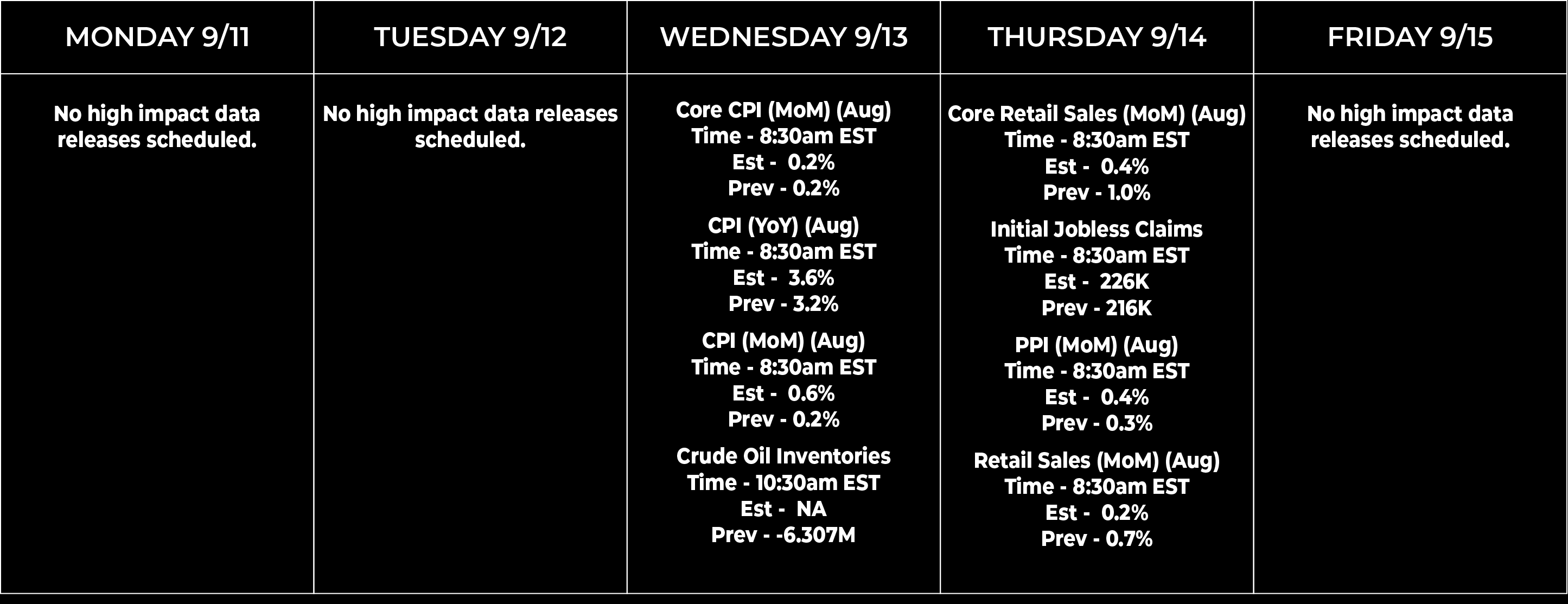

Economic Data Calendar